The February State of Freight webinar marked a significant shift in the discussion around freight markets, as experts concluded that the current rally has legs. The event's two-person roundtable, featuring SONAR CEO Craig Fuller and SONAR Zach Strickland, offered valuable insights into the market's trajectory and its potential for sustainability.

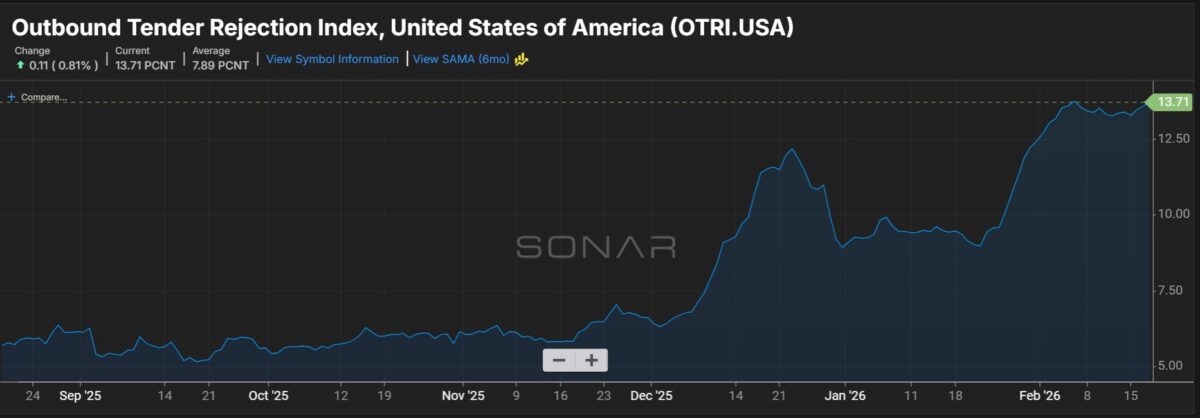

Fuller and Strickland agreed that the strengthening market is not going to fade away, citing conditions such as tightening capacity and industrial activity as key drivers of the surge. The Outbound Tender Rejection Index (OTRI) has been steadily increasing, with recent numbers reaching around 13.7%.

Industrial activity is a major factor in the surge, according to Fuller, who noted that the OTRI rate has always skewed towards industrial activity. This increase suggests that the recovery is starting to show up in manufacturing, particularly in the Midwest region where rejection rates have been rising.

The Midwest's tight freight market is unusual, with shippers reporting a corresponding surge not happening on the coasts, particularly the U.S. West Coast. This disparity highlights the regional differences in the market and underscores the importance of understanding these variations.

Shippers are becoming more selective and demanding quality, which is driving up contract rates. The use of tools like GenLogs enables shippers to better screen capacity, ensuring that freight stays safe and secure.

However, a drop in bankruptcies is not assured, as Fuller warned that company balance sheets have 'memories' and may be affected by the market's strengthening conditions. This could lead to an acceleration of bankruptcies in some cases.

Some market participants, including brokers, may not be primed to take advantage of the new conditions, as they may not have seen rising markets before. Brokers have discussed how the rise in spot rates has been painful for their margins, highlighting the need for a more nuanced understanding of what constitutes a great market.

Fuller's advice to shipping executives is to increase their budgets by 10% to account for the expected growth in demand. This would enable them to capitalize on the current market conditions and avoid missing their budget targets.

Overall, the freight market rally shows signs of sustainability, driven by factors such as industrial activity, capacity tightening, and shippers' increasing selectivity. As the market continues to evolve, it will be essential for participants to adapt and respond to these changes.

A strong freight market may be more sustainable than initially thought, with several factors contributing to its resilience.