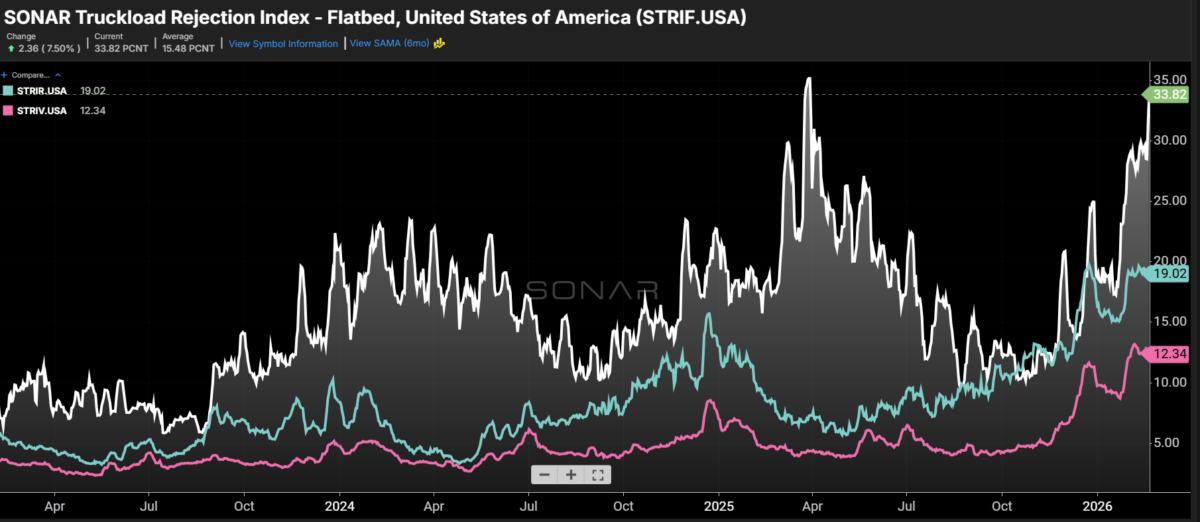

The trucking industry is experiencing a significant shift, with the latest data from SONAR indicating that flatbed tender rejection rates have jumped above 32% for only the second time in their eight-year history. This sudden increase is likely due to manufacturers' efforts to secure components and parts ahead of potential tariffs on North American trading partners. The first instance of this phenomenon occurred last March, when the surprise rollout of tariffs boosted cross-border flows as companies sought to stockpile essential supplies. It appears that this trend may be ongoing, with flatbed carriers and economists alike taking notice of the developing momentum in the manufacturing sector.

The flatbed market is heavily reliant on manufacturing, construction, and energy sectors, making it a crucial indicator of the overall health of the economy. While it's challenging to pinpoint the impact of any single sector, there are signs that suggest the manufacturing sector is gaining traction, which could have far-reaching implications for the industry as a whole.

The Institute for Supply Management's Purchasing Managers' Index (PMI) has trended higher since June 2023, with expansion in only four months since October 2022. January's reading of 52.6 was the strongest of that stretch, indicating modest gains in recent years. However, it's essential to note that this growth is still relatively slow compared to historical standards.

The SONAR Flatbed Truckload Volume Index has averaged roughly 18% higher year over year since the start of the year, while accepted tender volumes are up more than 10%. This suggests that the rise in rejections is not solely due to tightening truckload capacity, which affects all trucking segments. Instead, there appears to be a meaningful demand-side component driving this trend.

The dry van market, on the other hand, remains down year over year, albeit with comparisons becoming easier in the months ahead. This sector is more closely tied to retail and CPG sectors, which can shift to intermodal rail when capacity allows. In contrast, flatbed tenders reflect steadier, manufacturing-related freight compared to the more volatile spot market.

Flatbed tenders represent less than 5% of SONAR's total tender dataset but are crucial in reflecting the steady, manufacturing-related freight that is less influenced by inflation and freight mix. The upward trend in tenders is supported by recent spot rate data, with the Flatbed Truckload Index (FTI) measuring aggregated spot rates at 18% year over year.

The Supreme Court's ruling against the Trump administration's IEEPA tariffs has removed a significant headwind for goods demand, potentially boosting freight flows across transportation modes. While the path forward remains uncertain in terms of refunds and implementation details, this development could have a positive impact on flatbed and dry van markets, which have struggled to source components.

The auto sector may be more influenced by the upcoming USMCA review scheduled for July, but there are several reasons to believe freight demand has positive momentum. Flatbed growth was evident even before the winter storms and the tariff ruling. Potential tax incentives under the OBBBA may also provide additional support.

As the industry continues to navigate the complexities of tariffs and trade policies, it's essential to monitor the trend in flatbed tender rejection rates closely. The recent surge may signal a manufacturing renaissance, with manufacturers taking proactive steps to secure essential supplies ahead of potential disruptions.

The recent surge in flatbed tender rejection rates may signal a manufacturing renaissance, as manufacturers rush to stockpile parts and components in anticipation of tariffs on North American trading partners.