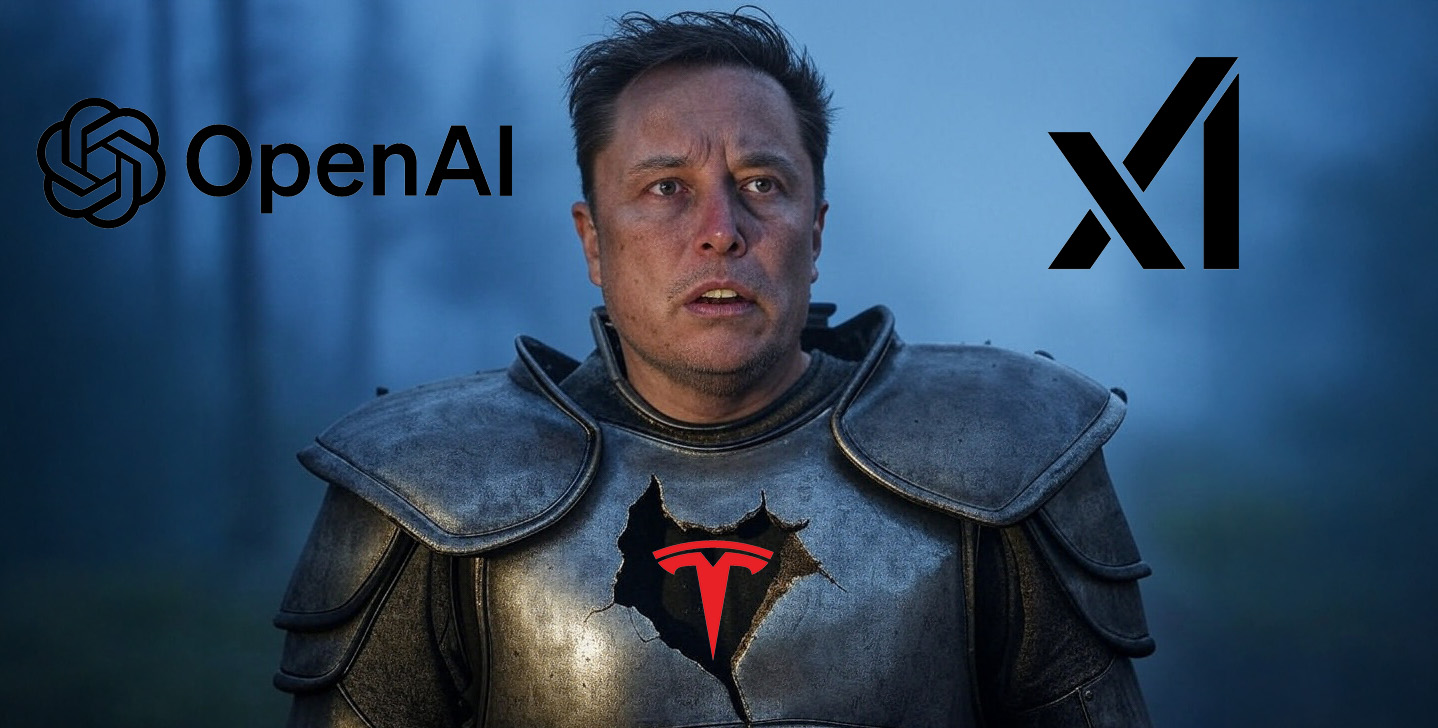

Tesla has disclosed a significant investment of $2 billion in its private AI company, xAI, founded by Elon Musk. The move comes as Tesla shareholders are suing Musk for breach of fiduciary duty over his founding of xAI. The investment was made on market terms consistent with those previously agreed to by other investors in the financing round.

xAI announced earlier this month that it raised $20 billion in its Series E round, valuing the company at approximately $230 billion. Tesla's $2 billion represents 10% of that round, but less than 1% of the company. Other investors in the round included Nvidia, Cisco, Qatar's sovereign wealth fund, and Fidelity.

', Tesla and xAI also entered into a framework agreement in connection with the investment. The framework agreement builds upon the existing relationship between Tesla and xAI by providing a framework for evaluating potential AI collaborations between the companies. Together, the investment and the related framework agreement are intended to enhance Tesla's ability to develop and deploy AI products and services into the physical world at scale.

This investment is subject to customary regulatory conditions with the expectation to close in Q1'2026. The move has raised questions about whether Tesla should be investing in Musk's private ventures at all while he's being sued for conflicts of interest. A truly independent board would have waited for the lawsuit to resolve before committing $2 billion in shareholder capital to the company at the center of the litigation.

Instead, Tesla's board approved the investment while the case is ongoing. The conflict isn't theoretical, as we've documented multiple cases of Tesla AI engineers being poached by xAI. These are people Tesla shareholders paid to train and develop, now working for Musk's private company.

Furthermore, xAI is reportedly burning through $1 billion a month trying to compete with frontier models from OpenAI, Google, Anthropic, and now Chinese models, which are way cheaper. The circular logic is breathtaking, as Tesla shareholders are suing Musk because he took AI resources from Tesla to xAI, and then they're paying him for it. This is the equivalent of someone being accused of stealing your car, and then you paying them for a ride.

Tesla's statement that the investment was made 'on market terms consistent with those previously agreed to by other investors' is meant to reassure shareholders this wasn't a sweetheart deal. However, the bigger question isn't whether Tesla got a fair price, it's whether Tesla should be investing in Musk's private ventures at all while he's being sued for conflicts of interest. The investment and the related framework agreement are intended to enhance Tesla's ability to develop and deploy AI products and services into the physical world at scale.

This investment is subject to customary regulatory conditions with the expectation to close in Q1'2026. In this context, it's essential to consider the implications of such a significant investment on Tesla's strategy and future prospects. The move has sparked debate among investors and analysts about whether Tesla should be focusing on its core business or exploring new ventures through investments like xAI.

As the situation unfolds, one thing is clear: the relationship between Tesla and xAI will continue to be scrutinized by shareholders and regulators alike. The investment and the related framework agreement are intended to enhance Tesla's ability to develop and deploy AI products and services into the physical world at scale. This investment is subject to customary regulatory conditions with the expectation to close in Q1'2026.

This investment raises significant concerns about conflicts of interest and whether Tesla should be investing in Musk's private ventures while he's being sued for breach of fiduciary duty. A truly independent board would have waited for the lawsuit to resolve before committing $2 billion in shareholder capital to xAI.