The newly released Epstein files have revealed extensive correspondence between two current Tesla board members, CEO Elon Musk and his brother Kimbal Musk, and the convicted sex offender Jeffrey Epstein. The documents contradict Elon's public claims about his relationship with Epstein, show that Epstein was arranging women for Kimbal, and expose conduct that would be unacceptable in any company with functioning corporate governance.

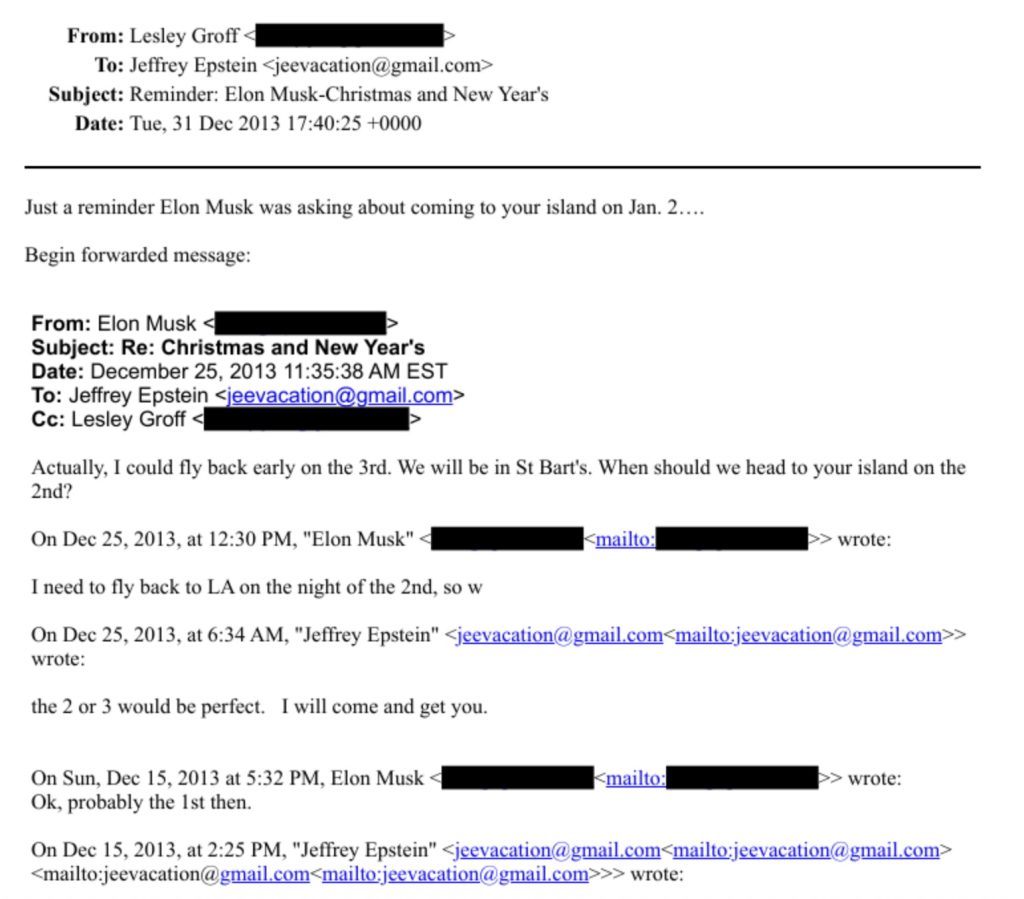

Despite this, Tesla shareholders have prioritized stock price over all else, leaving questions about the company's accountability and oversight. The files also raise concerns about Elon Musk's decision to visit Epstein's island, which he initially claimed he had refused to do.

In reality, Musk was actively coordinating the trip and even sent a Google Calendar notification for December 6, 2014. ' The correspondence highlights the close relationships between Tesla board members and Epstein, which have been previously unknown or downplayed.

As a result, investors are left wondering how far they are willing to go to make a buck, prioritizing stock price over ethics and accountability.

The revelations surrounding Elon Musk's ties to Jeffrey Epstein raise serious concerns about the lack of corporate governance at Tesla. It is essential for companies like Tesla to prioritize transparency and accountability, especially when it comes to their leadership's personal relationships with individuals who have been accused of wrongdoing.