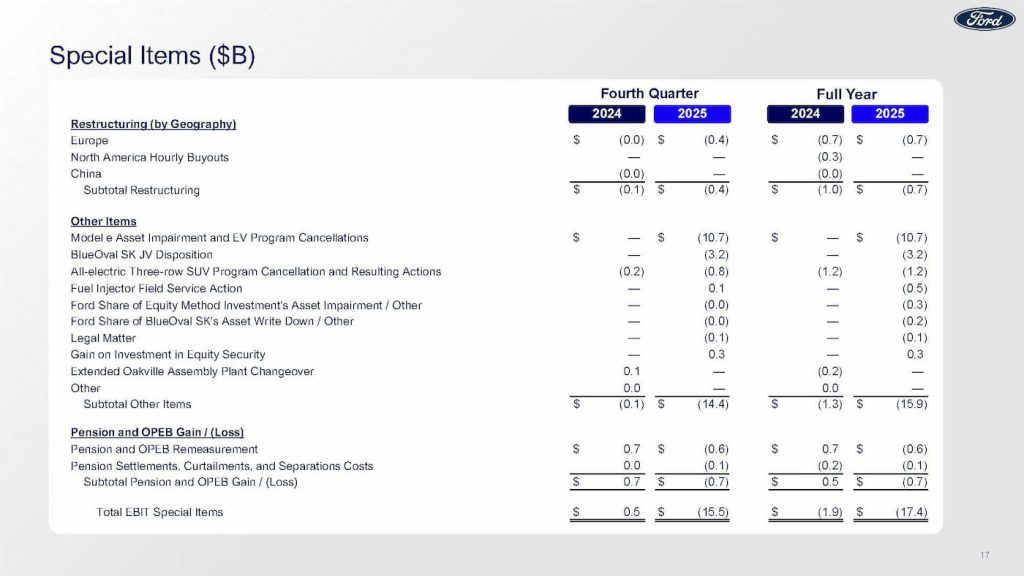

Despite beating top-line estimates, Ford's updated electric vehicle plans took a bigger toll on profits than expected in its fourth-quarter and full-year 2025 earnings. 1 billion in the fourth quarter, its worst performance since 2008, due to special charges related to its electric vehicle business.

7% from 2024, and crosstown rival GM sold 169,887 EVs in the US in 2025, up 48% from the prior year. As part of its updated Ford+ plan, revealed in December, Ford is betting on new hybrids and lower-priced electric vehicles based on its Universal EV platform, with plans to launch five new vehicles priced under $40,000 starting with a new midsize electric pickup in 2027.

The company has already ended production of the current all-electric F-150 Lightning pickup with plans to replace it with an extended-range electric vehicle around 2027. 5 billion in total.

13, beating top-line estimates, but its net loss reached a record high. 8 billion.

The company is focused on improving costs through next-gen affordable EV models and leveraging partnerships to reduce capital costs. In December, Ford announced a partnership with Renault to develop lower-cost EVs for Europe based on its Ampere platform.

For the full-year 2026, Ford expects an adjusted EBIT of $8 billion to $10 billion, broken down by segment.

Ford's shift towards new hybrids and plug-in hybrids is a strategic move to improve profitability in the near term, but it may come at the cost of its electric vehicle business. With the industry rapidly evolving, Ford must balance its investments in emerging technologies with its need for short-term financial stability.