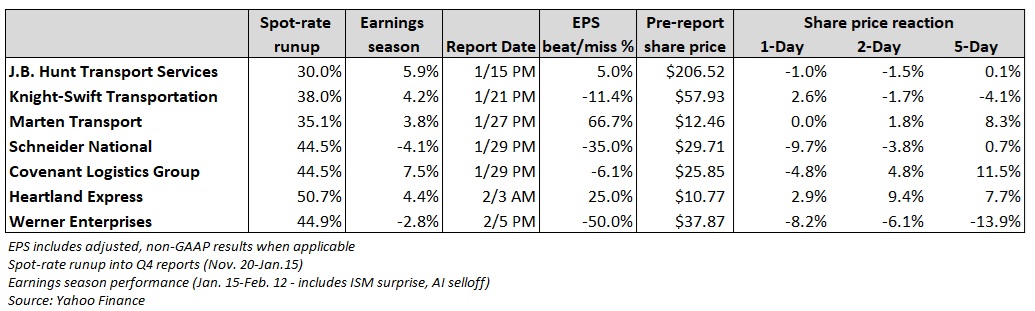

Truckload stocks appeared priced for perfection heading into the fourth-quarter earnings season, with shares running more than 40% higher from the week before Thanksgiving to mid-January. The move was in lockstep with rising tender rejections and spot rates. Earnings misses and lackluster outlooks were set to be punished until a surprisingly positive manufacturing update provided the group another shot in the arm. However, that bump was partially dashed by a tiny tech company touting plans to disintermediate the space.

The optimism surrounding TL stocks was short-lived, as shares moved sideways after the first couple of reports. However, TL and less-than-truckload stocks jumped in the first week of February after January's Purchasing Managers' Index report showed life across the manufacturing complex for the first time in a year. This rebound was largely driven by improved fundamentals, which came late in the quarter, leaving the period more indicative of the prolonged downturn.

The group then sold off following the Thursday release of a white paper from a largely unknown company, claiming its AI tools will significantly overhaul freight brokerage and generate large savings for users. Algorhythm Holdings said its formula has unlocked significant reductions in empty miles and headcount. However, industry participants and analysts largely panned the claims, citing concerns over mass collaboration and the need for siloed tech stacks to achieve stated synergies.

The news caused a mid-teen percentage selloff in 3PL stocks and dragged down shares of asset-based carriers by mid-single digits. Despite this, some carriers were up low-single-digits in midday trading on Friday. The positive and negative updates skewed post-earnings stock reactions for some carriers, highlighting the volatility of TL stocks.

J.B. Hunt Transport Services delivered more positives than negatives in the fourth quarter, with adjusted operating income up 11% year over year despite revenue dipping 2%. The company noted that it is taking market share but that the wins may have more to do with being aligned with winning customers than an overall lift in demand.

Knight-Swift Transportation reported a headline net loss in the fourth quarter, but its first-quarter guidance was in line with consensus. The company expects to achieve margin improvement in 2026 even if volumes and rates don't improve. Knight-Swift has removed $150 million in expenses from its TL business, representing 120 bps of unit operating margin.

Marten Transport reported year-over-year declines in operating results but saw some improvement sequentially. Revenue was down 9% year over year with adjusted operating income falling 31%. However, gains on equipment sales were a tailwind both year over year and sequentially. Marten has been focused on improving tractor utilization, which contributed to the improvement.

Schneider National's fourth-quarter and 2026 outlook came in below expectations, sending shares as much as 18% lower in the trading session following the report. The company cited softer market conditions and severe weather-related costs as drivers behind the earnings shortfall.

Covenant Logistics Group posted a modest miss on an adjusted basis but said heightened regulatory enforcement is pushing capacity from the market. The company has tightened plans around capital allocation, intentionally shrinking its fleet to improve truck utilization and margins.

Heartland Express reported 10 straight net losses excluding one-time real estate gains but logged sequential margin improvement in each of the past three quarters. The company pointed to positive signs around customer volumes and rates but said a recovery is unlikely to occur until some months later in 2026.

The positive and negative updates skewed post-earnings stock reactions for some carriers.