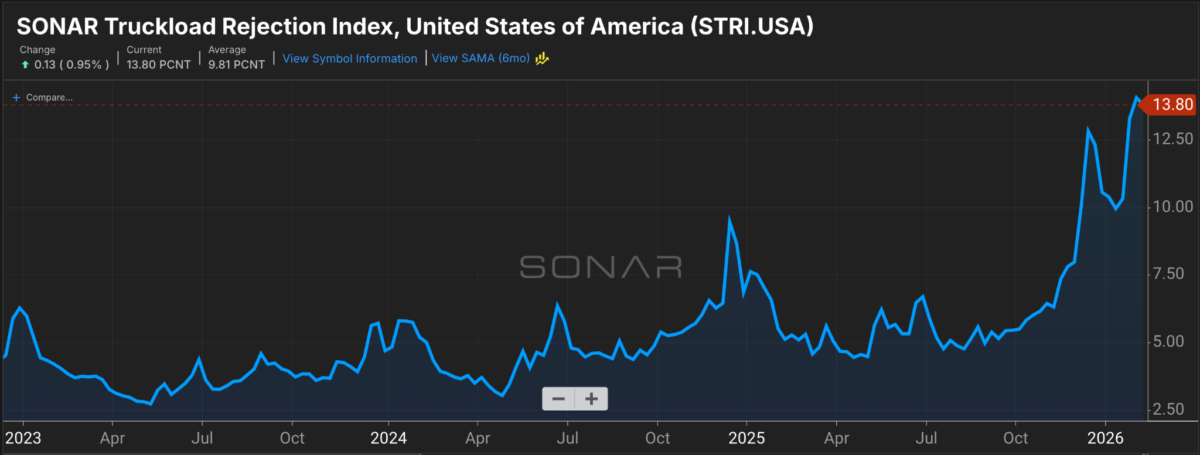

The freight market has been sending mixed signals for months, but one trend stands out clearly as we move deeper into 2026: trucking spot rates have staged a meaningful recovery. Truckload spot rates are holding elevated around $2.80 per mile nationally, up 23% from a year ago where it was at $2.33 per mile. This surge in trucking spot rates is having a significant impact on the industry, with tender rejections hovering near 14%. Carriers are rejecting loads, pushing spot pricing higher, and creating real headaches for shippers' routing guides.

Meanwhile, intermodal rates remain stubbornly anchored near cycle lows. Domestic intermodal spot rates (excluding fuel) sit at $1.39 per mile, down from $1.48 per mile a year ago, a decline of 5%. This divergence between trucking and intermodal rates is not new, but it's starting to show signs of reversal.

The market's shift in the past couple of years has seen shippers chase cost savings by shifting longer-haul freight to intermodal, especially as truckload capacity was abundant and spot rates soft. Railroads capitalized on excellent service reliability entering its second year of strong performance, excess container availability, and aggressive pricing to capture share.

However, the market is shifting under our feet. Trucking capacity continues to tighten due to ongoing carrier exits, regulatory pressures on drivers, winter weather disruptions, and early signs that domestic freight demand is returning. Tender rejections remain multi-year highs throughout the country, but especially in the Midwest, where capacity remains incredibly tight.

Trucking is set for a banner year, with both tightening capacity and demand moving in the direction that favors motor carriers. Shippers could experience multiple rounds of rate increases by the end of the year, with some models showing double-digit contract rate increases by December.

The intermodal pricing advantage, while still attractive, is starting to look vulnerable. Truckload provides the effective 'ceiling' for intermodal rates — railroads can't price too far below trucking without risking margin erosion, but they also can't ignore a tightening over-the-road market forever.

Several catalysts could accelerate this shift: as spot truckload strength persists and potentially bleeds into contract renewals later this year, intermodal providers will face pressure to adjust. Shippers should prepare for this shift, especially those locked into long-term intermodal contracts who may see renewal pressure.

The freight market rewarded patience through the downcycle. Now, it's rewarding those positioned for the inevitable rebalancing. In 2026, intermodal's lag ends — and rates rise to reflect the new reality.

As trucking spot rates continue to recover, shippers will need to reassess their strategies and consider alternative modes of transportation. With intermodal rates poised to catch up, shippers may find themselves facing less aggressive discounts or even renewal pressure on existing contracts.

As trucking spot rates continue to recover, shippers may see intermodal rates follow suit in 2026.